The best freelancer accounting software

Table of Contents

To succeed as a freelancer, you need strong financial management. But this can be overwhelming and time-consuming. That is why you need the right freelancer accounting software. It has the potential to give you important insights, and save you time on financial admin so that you can focus on running your business.

This guide will discuss what to look for in the best freelancer accounting software, including:

- What should the best freelancer accounting software include?

- How can accounting software help freelancers?

- How can freelancers get started with Countingup?

What should the best freelancer accounting software include?

The best freelancer accounting software must include features that streamline the process, save you time, and save you from stress. Trusted by over 40,000 customers, the Countingup app is the unique two in one business account and accounting app that’s specifically designed to do just this for freelancers.

When you sign up for Countingup, you’ll get access to innovative accounting tools in the palm of your hand including:

Live cash flow insights

The Countingup app gives you real-time insights into your business’s cash flow to help you assess and improve your business performance on a daily basis. Plus, it will show you when your cash flow is looking thin. This knowledge is essential because many businesses fail due to cash flow issues. If you don’t have the cash to cover short term financial obligations, you’ll struggle to maintain your business.

Use the Countingup app to study your cash flow and see what marketing methods work best for your client base. If you have negative cash flow, you can find ways to cut down on expenses and increase profits.

Automatically categorised expenses

The best freelancer accounting software helps you organise your expenses by automatically sorting your expenses. Countingup instantly assigns your expenses to HMRC-approved categories, saving you hours of admin time when it comes to submitting your tax return. The categorised transactions will make it easier for you to list your deductible expenses, helping you save on your tax owed when it comes to submitting your Self Assessment.

This makes it easy to keep track of, analyse, and find proof of expenses when necessary. Learn more about how Countingup categorises your expenses here.

Receipt capture tool

Did you know businesses have to store their financial records for up to 6 years? You can use the Countingup receipt capture tool to take a picture of your proof for business expenses. You’ll get a notification to snap a picture after your transaction, so you won’t have to dig up those paper receipts later when you need proof for HMRC.

Invoicing as you go

Working as a freelancer can lead to an irregular schedule, with some weeks more hectic than others. Software like Countingup’s allows you to manage your invoices quickly and efficiently.

The app allows you to create and send an unlimited number of customised invoices from anywhere, making your business operations mobile. You can even add your business logo to your invoices to appear more professional.

On top of this, Countingup customers can:

- Create an unlimited number of customised invoices (free)

- Add a logo to invoice templates

- Send invoices to customers

- Receive a notification when an invoice is paid

- Match a payment to an invoice

- Duplicate an invoice

- Change an invoice’s due date

Overall, Countingup offers tools that streamline your financial management and make it easier for you to manage your money and grow your business.

How can accounting software help freelancers?

Freelancers often work on more than one client or project at once. Their work and earnings come on a case to case basis, and they usually take on short term contracts. Because of this, managing finances can be tricky as a freelancer.

There are many ways that accounting software can help your freelance business. By using a simple accounting software app like Countingup to organise your finances, you can focus on your business growth.

Better understand your freelance finances

Technology can help you stay on top of your business finances so you can have a better understanding of how much you earn and spend. Software puts everything in one place so you can better manage your cash flow. As a result, you can make a clearer budget for your business and invest excess cash towards marketing and growth projects.

In particular, cash flow can help you see when you’re busier or slower with clients. With this knowledge, you can plan for lower-income periods and offer sales to increase your client base.

Overall, visibility over your finances can help you grow your business with more insight.

Save time

With easy-to-use accounting software, you can save valuable time on your financial management. If you do your bookkeeping and accounting on your own, you likely spend time crunching numbers that you could instead be putting into money-making projects. This can be both time-consuming and stressful.

For example, if you’re a freelance writer with five projects to complete in one week, you won’t want to waste time drafting invoices and processing payments from your clients. You need that time to write. The best freelancer accounting software will automate and update these time-eating tasks so you can focus on what matters.

The Countingup app makes it easy to manage your finances on the go. You can quickly create and duplicate invoices for clients and automatically get invoices matched to payments. In addition, you’ll receive notifications on your phone when a client pays you. Countingup offers automatic bookkeeping tools such as expense categorisation that do the work so you don’t have to.

Make taxes easy

As a freelancer, you have to manage your own taxes and file a Self Assessment tax return to determine what you owe HMRC each year. This can be confusing and time-consuming when you manage your own finances. Since freelancers often work on short-term projects from various clients, it can be difficult to keep track of your overall earnings and spending for taxes.

Fortunately, modern accounting software like Countingup makes sure that all your financial information is in one place. The app estimates your taxes year-round so that you don’t have any surprises when it comes to Self Assessment season. You can share your financial data with your accountant so they can easily access all the information required to file your taxes for you.

3 months free with the best freelance accounting software

Financial management can be stressful and time-consuming when you’re self-employed.

That’s why thousands of business owners use the Countingup app to make their financial admin easier.

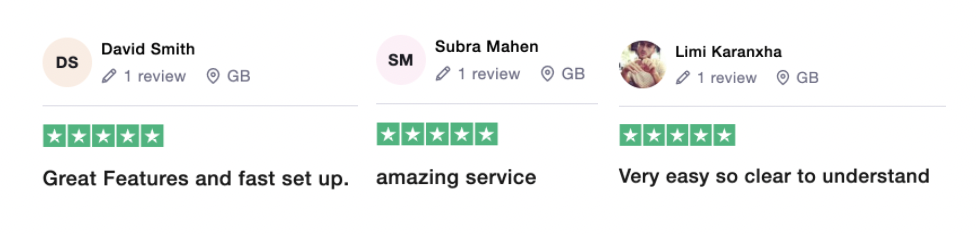

Rated ‘Excellent’ on Trustpilot, Countingup is the business current account with built-in accounting software that allows you to manage all your financial data in one place. With features like automatic expense categorisation, invoicing on the go, receipt capture tools, tax estimates, and cash flow insights, you can confidently keep on top of your business finances wherever you are. It’s no wonder people call it ‘the best in the UK’ and consider it ‘terrific software so easy to use.’

You can also share your bookkeeping with your accountant instantly without worrying about duplication errors, data lags or inaccuracies.

Find out more and sign up for your free trial here.

Receive actionable business tips weekly

By submitting this form, you confirm that you are 16 years of age or over and that you have read and agree to our Privacy Policy. You can unsubscribe at any time.