What is double-entry bookkeeping?

Table of Contents

As a business owner, you need to keep financial records and log any transactions you make through the company. One way you can keep track of these transactions is by using double-entry bookkeeping.

This guide will explain double-entry bookkeeping by covering the following:

- What double-entry bookkeeping is, and how it works

- What’s included in double-entry bookkeeping

- How it’s different from single-entry bookkeeping

- How do to double-entry bookkeeping

- How Countingup can help with your bookkeeping

What is double-entry bookkeeping?

Double-entry bookkeeping is a method that tracks when, where and how money enters and leaves your business (your cash flow). Double-entry bookkeeping is used to get the total amount from the formula below:

Assets = Liabilities + Equity (these components are explained below)

In this form of bookkeeping, you enter every transaction twice: once as a debit (adding money) and once as a credit (subtracting money). These entries show if money was transferred to or from an account.

Every entry you make will affect two different accounts. For example, if you sell one of your products, your cash account goes up, and your inventory account goes down. We’ll explain more about how this works in a later section.

When making entries into your general ledger (a logbook where you record your financial activities), you add debit entries on the left and credit entries on the right. You summarise these entries in a ‘trial balance’, which shows the account balances and the total amount of your debits and credits.

If done correctly, your credit balance should be the same as your debit balance.

What is included in double-entry bookkeeping?

Let’s take a closer look at the different parts of the double-entry bookkeeping formula:

Assets

Assets are items or resources that have financial value. This can include both physical items, such as vehicles or equipment, and sometimes intangible (non-physical) items like copyrights or branding. A company’s assets are often separated into two groups, based on how quickly it can turn that asset into cash.

Current assets can be converted into money within a year as they are fairly simple to sell and value, such as:

- Stock and inventory

- Cash in the bank

- Money owed to you (accounts receivable)

- Customer deposits

- Office furniture, equipment or supplies

- Phones or laptops

Fixed assets are valuable items that would take longer to get the cash in your pocket, such as:

- Property or buildings

- Machinery

- Specialised equipment for your business operations

- Investments like stocks or bonds that may take a while to cash out

- Vehicles

Liabilities

Liabilities are the funds that you owe to other people, banks or businesses and can cover a variety of debts, including:

- A business loan (the total, not the monthly payment amount)

- A mortgage or rent payment on a property

- Supplier contracts you owe

- Your accounts payable total

- Other financial obligations, such as paying wages or freelancers for support

- Taxes due to be paid to HMRC

Think of your assets like money going into your pocket and liabilities, as the items that take it out of your hands. This might help you when listing items and making sure you don’t forget anything.

Equity

Equity is the cash value of an asset you own after deducting any remaining payments of liabilities.

When it comes to your business, your equity is the value of all your business assets, minus the money you owe on them. This remaining value is the equity you own in your business (often called ‘Owner’s Equity’).

Basically, your owner’s equity shows how much you would be left with if you sold all your assets and paid all your debts.

Debit and credit

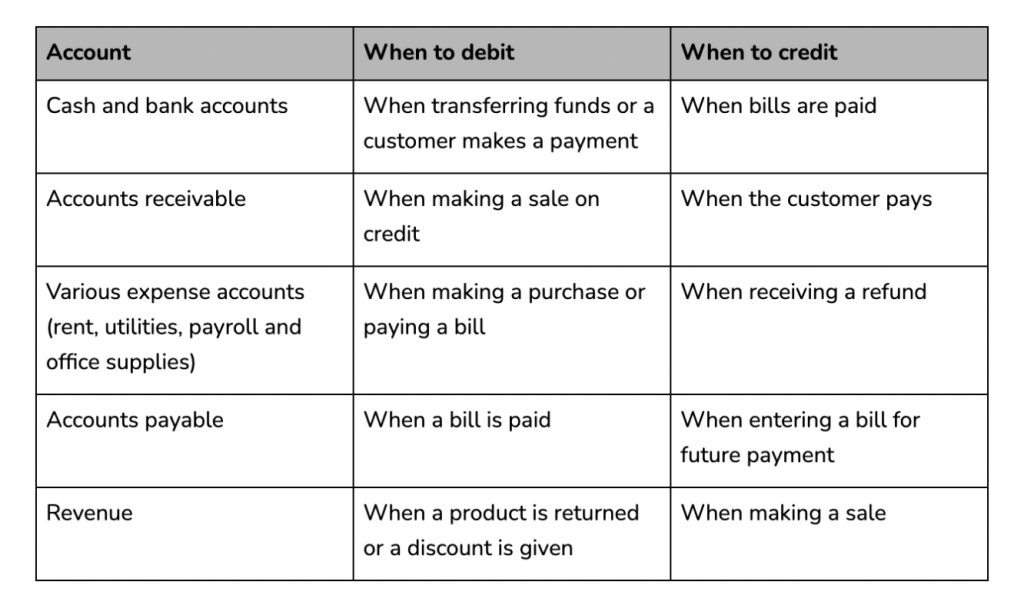

As we’ve explained, debits happen when you add something to accounts, and credits happen when you remove something. We created a chart that helps you understand how debit and credit affects different accounts:

You can learn more about these accounts and how debit and credit works in business accounting in this guide.

How is double-entry different from single-entry bookkeeping?

If you’re running your own business, you might already use single-entry bookkeeping. This method only requires you to record entries once by writing down all your company transactions (revenue from sales, expenses, etc.) in a single ledger. While single-entry bookkeeping is the quicker and easier method, it’s arguable not the best option as your business grows.

Why? Because single-entry bookkeeping doesn’t track your assets and liabilities, meaning you don’t get a complete view of your business’ financial health.

What makes double-entry the more reliable option is that it gives you (and your accountant, if you have one) enough information to fully understand how your business is performing.

How do I do double-entry bookkeeping?

Here is an example to help you get a better understanding of how double-entry bookkeeping work in practice:

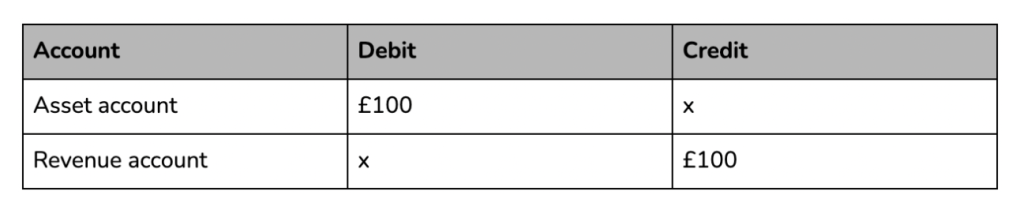

If you sell a product to a customer for £100 in cash, the sale will result in £100 in revenue (money made from sales) and cash. You record this transaction as a debit in the Asset account and increase the revenue account with a credit.

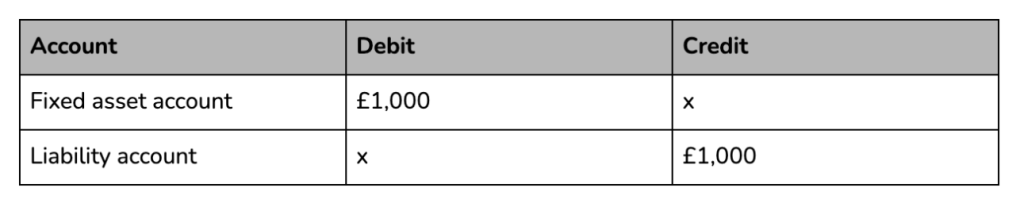

Let’s look at another example. You decide to buy new equipment for your business that costs £1,000. The equipment is a fixed asset (meaning it’ll last for more than a year), so you add the cost as a debit on your Fixed asset account. Buying the equipment also means you increase your liabilities, so you increase your accounts payable account (which lists the money you owe) by crediting it £1,000.

We hope this guide gave you some clarity into how double-entry bookkeeping works. Using accounting software like Countingup will help you gain a better understanding of your finances. The app also helps you stay on top of your transactions with ease. Find out more below.

Save time on your bookkeeping with a simple app

By setting up a Countingup business current account, it’s easier to keep organised when it comes to your bookkeeping.

The app comes with free built-in accounting software that automates the time-consuming aspects of bookkeeping and taxes. You can view real-time insights into your business’ finances, profit and loss statements, tax estimates, and you’ll be able to create and send invoices in seconds.

You can also share your bookkeeping with your accountant instantly, without worrying about duplication errors, data lags or inaccuracies. Find out more here.

Receive actionable business tips weekly

By submitting this form, you confirm that you are 16 years of age or over and that you have read and agree to our Privacy Policy. You can unsubscribe at any time.