What do debit and credit mean in accounting terms?

Table of Contents

Understanding the difference between debit and credit entries in your bookkeeping is a crucial part of interpreting your business’ financial health. Debit and credit entries are essentially the foundation of your accounting records.

But what do debit and credit entries mean in accounting terms? It can be tricky to wrap your head around how each type works.

This guide will help you understand how debit and credit work by exploring the following:

- The difference between debit and credit

- When we use debit and credit

- What debit and credit mean in accounting terms

- An example of debit and credit accounting

The difference between debit and credit

Debit and credit entries are bookkeeping records that balance each other out. Every transaction you make must be exchanged for something else for accounting purposes.

Simply put, a debit entry adds a positive number to your records, and credit adds a negative one.

A debit transaction increases asset or expense accounts and decreases revenue, liability or equity accounts. On the flip side, a credit transaction increases liability, revenue or equity accounts and decreases asset or expense accounts. We’ll explain each of these terms in more detail as well as how this works in practice in a later section.

When we use debit and credit

Debits and credits are used in double-entry bookkeeping, an accounting method where every entry in an account needs a corresponding and opposite entry in a different account.

This means that every financial transaction is recorded on at least two accounts, which are affected in equal and opposite ways. Double-entry bookkeeping ultimately gives you the basis for financial records like the balance sheet and income statement. Whenever you make or spend money, at least one account is debited and one credited.

Every transaction is recorded this way, which is why bookkeeping can be so time-consuming.

What debit and credit mean in accounting terms

As we’ve explained, debits happen when you add something to accounts and credits happen when you remove something.

The tricky part is understanding how credits and debits affect different accounts. For example, say you debit an account that shows how much you owe someone. Is that the same as debiting an account that shows how much you’ve just been paid?

It depends on what kind of balance the account normally holds: a credit or debit balance.

So, what accounts are affected by credit and debit entries? We’ve listed them below:

Asset account

Assets are items that provide future financial benefit to your business, such as:

- Cash

- Accounts receivable (money owed to you)

- Inventory

- Prepaid expenses

- Property and equipment

- Vehicles

Expense account

Expenses are costs related to your company’s day-to-day operations, including:

- Advertising

- Utilities (heat, wifi, electricity)

- Rent

- Travel

- Salaries (if you employ someone, even on a freelance basis)

Revenue account

Revenue accounts relate to income you earn from selling your products and services or interest you gain from investments. Examples include:

- Sales revenue

- Service revenue

- Interest income

- Investment income

Liability account

Liabilities are financial obligations that your company has to pay, like supplier invoices or loan repayments. Accounts that fall under liabilities include:

- Accounts payable (money you owe)

- Income tax payable (income tax you have to pay)

- Loans payable

- Bank fees

Equity account

Equity refers to your net assets, or the value of your company’s non-operational assets after liabilities have been paid, such as:

- Available-for-sale securities

- Stocks

- Bonds

- Mutual funds

- Real estate

- Pension and retirement plans

- Debt security

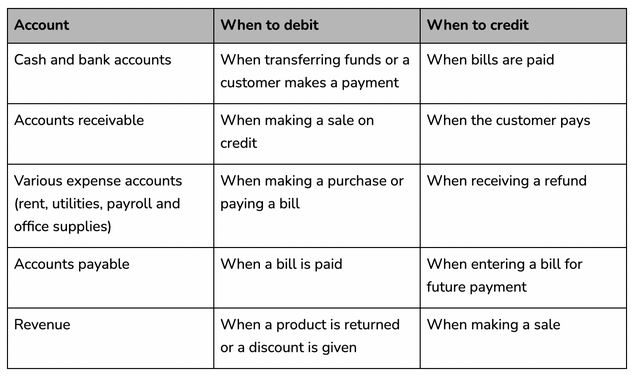

Below is a chart that shows you how to debit and credit different accounts:

An example of debit and credit accounting

Here is an example to help you get a better understanding of how debits and credits work in practice:

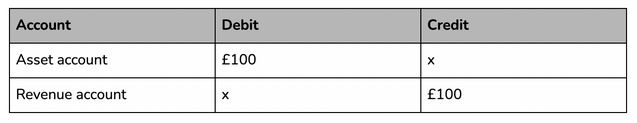

Say you sell a product to a customer for £100 in cash. In that case, the sale would result in £100 of revenue and cash. You record this transaction as a debit in the Asset account and increase the revenue account with a credit.

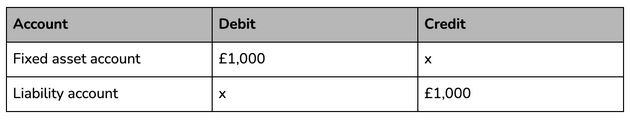

Let’s look at another example to give you even more clarity. You decide to buy new equipment for your business that costs £1,000. The equipment is a fixed asset (meaning it’ll last for more than a year), so you’d add the cost as a debit on your Fixed asset account. Buying the equipment also means you increase your liabilities, so you increase your accounts payable account by crediting it £1,000.

Now that this guide has cleared up the confusion about debits and credits, we hope you’ll be able to manage your finances with more ease. Countingup has a number of features that can further enhance your financial management!

Save time on bookkeeping admin with Countingup

Countingup is the business current account and accounting software in one app, automating the time-consuming aspects of bookkeeping and taxes. You can view real-time insights into your business finances, profit and loss statements, tax estimates, and create invoices in seconds.

You can also share your bookkeeping with your accountant instantly without worrying about duplication errors, data lags or inaccuracies. Find out more here.

Receive actionable business tips weekly

By submitting this form, you confirm that you are 16 years of age or over and that you have read and agree to our Privacy Policy. You can unsubscribe at any time.