6 reasons why you need a business plan before starting a business

Table of Contents

Sometimes success comes with luck. Otherwise, it comes with hard work and planning. If you’d like to maximise your success as you launch a business, this article is for you.

Learn six reasons you need a business plan before starting a business in this article by Countingup. If you’re new to business, a typical business plan includes research on market trends, competition analyses, customer profiles, marketing goals, logistics and operations plans, cash flow information, and an overall strategy on how they will grow.

Find out how a plan helps your business to:

- Know the market

- Plan your growth

- Minimise risk

- Help guide future decisions

- Improve as you learn more

- Secure financing

This article will cover why you should plan and how you can use these elements to build your business more effectively. If you’re ready to write a business plan instead, check out our dedicated article How to write a business plan. There we cover what sort of information is expected and useful in business plans and how to research them.

At Countingup, we want to empower new entrepreneurs to take on new challenges and be financially independent. Read on to find out more.

1) Know the market

If you’re to be successful in business, you need to know your market and the value customers are seeking within it. However, this can potentially be a lot of information to gather and manage. Therefore, you need a business plan to centralise and summarise all the important reasons why your business is valuable.

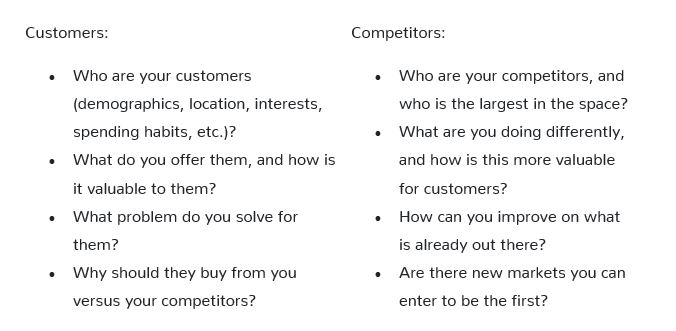

To do this, you need to consider two main perspectives: what your customers want and what your competitors are already offering. This second question is essential as it will allow you to identify how you can be different.

If you already have something of a business idea or would like to turn a side-hustle into a full-time job, you should do research to understand if your idea will be a viable business and how. This market research in your business plan should look something like the following:

From your research, you can build a detailed picture of where your business should be positioned as you launch from the market gaps you’ve identified.

2) Plan your growth

As you anticipate what your business might look like in five years, you may have some ideas for milestones to hit. For example: first customer, thousandth customer, break-even financially, first £1,000 in profit, and so on. However, do you know how you’re going to reach each of them?

From the market research you’ve just completed, your business plan allows you to take various steps to use this information. Therefore, you need a business plan to maximise your growth and create specific objectives and strategies to meet this growth.

For example, if you run a craft beer business, you might aim to sell 1,000 units within your first year. Your sales objective could be achieved with a strategy to ‘Attend trade fairs and beer festivals to meet potential retailers and interested customers’. Depending on the direction you choose in providing to retailers or selling directly to customers, you can reach this objective (first 1,000 units) in very different ways.

In contrast, if you run a consultancy business in financial services or marketing, you could aim to grow your client base to 12 full-time contracts across the year. Therefore, you might plan to ‘Use social media and industry contacts to advertise to clients’ or ‘Develop your service to retain clients for longer periods and larger projects’. These goals’ methods are critically different from one another – therefore strategies for your goals will need to be relevant and focused.

Once you’ve taken steps to meet these objectives, you can use your business plan to track your progress and identify where you still need to develop your business. With these formalised goals and methods, you can grow your business faster than entrepreneurs who don’t plan.

3) Minimise risk

Another direction in which to focus market research within your business plan is towards identifying vulnerabilities. Each business has fragile areas where they are threatened. Therefore, you need a business plan to protect weak points and avoid excessive risk sources.

From the SWOT analysis (strengths, weaknesses, opportunities and threats) included in your business plan, you can highlight areas that may need more proactive management and back-up plans in case something goes wrong. For example, this can be recognising whether your business idea is patentable, if external factors are driving up costs for consumers or if customer interest is a fading trend. Each of these threats and weaknesses presents vastly different problems to your business. Therefore, each will also need suitable methods to address them.

As you’re looking to start, having this awareness can mean you can anticipate problems ahead of time. Depending on the severity of these issues, you can take steps to cushion any damage or preserve your profits entirely. Without this insight, you leave yourself open to threats you were able to anticipate and mitigate but didn’t manage to – a critical oversight for any business owner.

On balance, having this awareness of weaknesses and threats can be more important than your opportunities, as you’ll be aware of steps to avoid and what to look out for. Therefore, outline threats to your business’ future to protect it.

4) Help guide future decisions

Unfortunately, even the best plans have blindspots and circumstances where they’re of limited use. Therefore, you need a business plan to navigate uncertain futures.

Your market research is a snapshot of the market at one point in time. Therefore, the information, objectives and strategies you create are only useful for a certain period after this. If something changes in the market or some element of your business no longer works, you can still fall back on other parts of your business plan without having to start from scratch.

For example, as you build your business, you can revisit future objectives and decide whether your currently available options can still meet them. If they do, and you’re able to stay on target for your goals, you can grow your business in the direction you initially planned. However, where your plan hasn’t worked out, you’ll need to decide to the best of your ability.

Navigating these future scenarios with updated information is especially important as you balance the short and long-term priorities of growing your business. For example, do you want to take more money to compensate yourself or reinvest a higher proportion of your profits in the hopes of growth later on?

Even if you’ve planned to reinvest every penny for the first 5 years, maybe something in your personal life has meant you need to support yourself.

Some critical information to look out for as your business plan evolves includes:

- Demand lower than predicted

- Cash flow issues due to poor forecasting

- Not enough differentiation from competitors

- Prices too high or too low for the industry to be sustainable

5) Improve as you learn more

As the months and years pass by while you trade and grow your business, you can update your plan with more insight. Therefore, you need a business plan to improve your business.

As an example, in some instances, a manufacturing process is harder than anticipated or a planned funding source isn’t available. Here, you can adapt your growth strategies based on this new information and update your plan to be more pragmatic and accurate. Similarly, if you find that certain marketing strategies don’t work, you can rule out certain business strategies in the future to expand your business with more confidence.

There would be little point in planning a course of action for your business, facing difficulties and then not updating your plan with a new direction. This would risk your business being disorganised and ineffective in its growth.

Even if your initial plans and growth strategies go the way you planned, at a certain point, your plan will expire anyway. This is because you can only plan so much on a single market snapshot. Therefore, you can use the experience you gain with time from growing your business to fine-tune your plans. This will make sure your business is always performing at its best within an evolving marketplace.

6) Secure financing

Finally, investors and lenders want to see entrepreneurs with a good understanding of what they offer to customers and a clear vision of how to grow their business. Therefore, you need a business plan to help convince other people that your business has value and potential.

When seeking funding, having a business plan to share with potential investors and lenders is sometimes a requirement as they’ll want to evaluate your claims more critically. While they may not be familiar with every business plan they come across, they may know more about typical business growth patterns and will be able to spot poor research or naive expectations.

Therefore, having a detailed and realistic business outline can help your plan withstand their criticism and robustly show your growth potential. Similarly, if you’re considering an exit strategy to sell your business in the future, a business plan may be needed to secure a higher valuation.

If you’d like to know more about communicating your business’s value and plan to secure funding, read our dedicated article How to present a business plan to potential investors.

Making informed business decisions

Make your business plan more effective with Countingup.

Countingup is your business current account and accounting software in one app. With it, you can automate your financial admin and save time – so you can get back to doing what you love.

The Countingup app offers real-time profit and loss data so you detect changes in your business’ performance as they happen. So you’ll be able to see success instantly if you change your marketing strategy.

Get paid faster and improve your cash flow with automated invoicing. Gain complete confidence in your books as they’re always accurate and up to date – even if you’re on the go – with automatic expense categorisation and prompts for receipt capture as you make transactions.

Countingup’s tax estimate tool will help you confidently set aside the right amount each year to pay any tax owed. Find out more here and sign up for free today.

Receive actionable business tips weekly

By submitting this form, you confirm that you are 16 years of age or over and that you have read and agree to our Privacy Policy. You can unsubscribe at any time.