How to create a monthly business budget – with template

Table of Contents

Who said budgets couldn’t be fun? Okay, yeah, not everyone will enjoy it. But you’ve got to do it to run your business successfully.

You can’t let your finances slip out of control, or you’ll be unable to pay for things you need and not benefit from your earnings. Luckily, understanding monthly budgets can make life a little easier for you.

There’ll be no promises for making budgets any more enjoyable, but if you have an idea of how they work, they won’t be so time-consuming. Luckily, we can offer a bit of an explanation and even a template to use.

Once you know what each part of the budget means and where you should be put things, you’ll be able to make your own.

Budgets can be over quarters or years, but we’ll focus on monthly ones for this guide. You’ll be able to draw up a new one before every month starts, then review it when it ends.

This guide discusses the key points of a monthly business budget template:

- What’s a budget?

- What’s revenue?

- What are expenses?

- How about a template? (Don’t worry, we’ve got you)

- Bonus: How can budgeting be even easier?

What’s a budget?

Starting, you’ll want to know what a budget is and why you need one.

Your budget is your estimated revenue and expenses (we’ll get onto those in a minute) over a future period.

The idea behind one is for you to anticipate how much you’ll spend. If you have those figures laid out, it helps you look back at the end of that period and see if you stuck to it.

Sometimes things come up that’re entirely out of your control. For example, if there’s a shortage in your supplies, the price you have to pay may increase.

There’s no way to prevent a situation like that, and you’ll end up being over budget. But keeping track of variances will help you predict them and keep them in mind when you budget for the next period.

That’s what it’s all about, and really, budgets allow you to learn and plan ahead. The longer you do them, the more accurate they’ll get.

If you spend more than you expected, that’s called a deficit, and you’ll have to find that extra money from somewhere. When you’re lucky, you’ll have more money left over – that’s called a surplus.

Over time, the more months you make a budget, you’ll be closer to getting it balanced. Balancing means that the money coming in matches the money coming out.

What’s revenue?

Your ‘revenue‘ is the money that your business generates. Most of it will come from whatever product or service you sell.

It’s essentially your sales, and sometimes known as your ‘top line‘, which is easy to remember because, on your budget, it will be at the beginning.

Even though most of the money coming into the business is likely from regular income, there are other ways to get revenue.

One of these other streams of money could be from interest. If your business has savings, they could generate interest for you. Alternatively, you may have investments in other companies which provide you with dividends.

Dividends are shares of a company’s profits and that are distributed to its shareholders.

Other forms of non-sales revenue can include allowing other businesses to rent your property or equipment. For example, if you have a t-shirt business, you could rent your printers for others to use.

What are expenses?

Your costs that are necessary to continue as a business are called ‘expenses‘. Without paying them, you’d be unable to make any money through revenue.

Unfortunately, you can’t have one without the other, it costs money to make it. So everything that goes into that process of generating revenue is an expense.

These can include expenses for supplies, manufacture, salaries (even if it’s just yours) and keeping the lights on at your office or factory.

There are two types of expenses you’ll have to keep an eye on — operating and non-operating.

Operating expenses

Like the previous examples, your operating expenses are costs to pay to continue working.

Non-operating expenses

A little different, non-operating expenses need to be paid regardless of whether you are operating. The most common is interest on loans.

Even if you don’t operate and make money, you’ll still have to pay it off if you have a loan. So it’s an expense that isn’t affected by what’s coming in.

How about a template? (Don’t worry, we’ve got you)

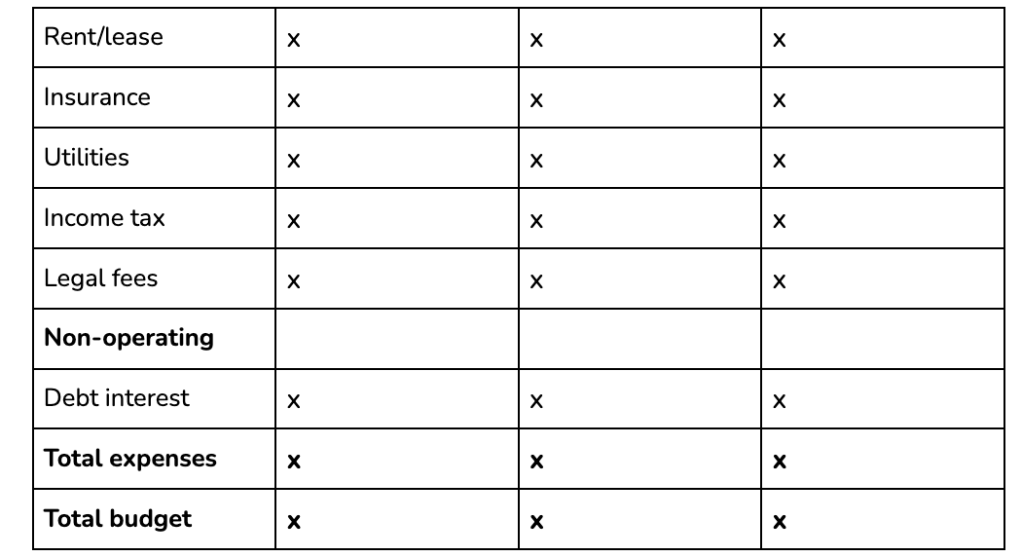

Now, the moment you’ve been waiting for. You’re ready to input your revenues and expenses into a budget. Here’s a monthly business budget template for you:

Operational budget

For the month of: (x)

Hope you enjoyed your monthly business budget template? It’ll help you put your monthly business budgeting together using the template (a bit of a mouthful).

BONUS: How can budgeting be even easier?

Now you’ve mastered the basics of budgeting – we’ll let you in on a bit of a secret. What if you had an app to hold all your financial information in one place?

Well, you took the right path because Countingup is a business account with built-in accounting software. It means that you could benefit from all of your costs laid out using the app’s expense categorisation feature.

That means that everything you need to make a budget gets a lot easier. But what about an additional benefit?

When it sorts expenses, Countingup uses HMRC approved labels so, if you love how exciting it can make budgeting – imagine what it’ll do for your taxes.

Receive actionable business tips weekly

By submitting this form, you confirm that you are 16 years of age or over and that you have read and agree to our Privacy Policy. You can unsubscribe at any time.