What is the difference between gross and net profit

Table of Contents

Profit is categorised in two ways: gross and net. Each is important in different contexts, so which is which, and what do they both mean?

In this article, we’ll discuss:

- What is gross profit?

- How can you calculate gross profit?

- What is net profit?

- How can you calculate net profit?

- How Countingup can help you understand your different profit figures.

Whether you’re a sole trader or you’ve just launched an exciting new small business venture, read on to find out how Countingup can help you understand your different profit figures and how to use them effectively. We have recently developed a free profit margin calculator.

What is gross profit?

Gross profit refers specifically to the profit you make from your product or service. Gross profit, sometimes referred to as “gross income”, accounts for how much your goods/products cost to sell in the first place.

Because gross profit is used for later figures (like net profit, discussed below), it’s often overlooked. However, gross profit can still be useful since it directly tells you how your products or services are performing. Your gross profit will reflect if and where your sales and marketing strategies are effective.

How do you calculate what your gross profit or income is? And how can you boost this figure for future trading? Continue reading to find out.

How can you calculate gross profit

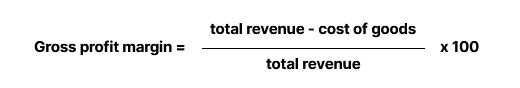

Depending on the context, you might need to calculate your gross profit as a number, or as a percentage. You can calculate your business’ gross profit by subtracting your cost of goods from your total revenue:

Gross profit = total revenue – cost of goods

Depending on your business, your cost of goods may include a more exhaustive list. Typically, cost of goods includes raw materials and inventory, staffing, delivery, and more.

If you need this figure as a percentage instead (to find out your gross profit margin), take the figure you’ve just calculated and divide it again by your revenue, then multiply by 100.

It is possible for your gross profit to be a negative number. Here, while your individual margins per unit sold might be good, your total cost of goods still outweighs your total revenue. While this can often mean further losses impacting your net profit, being able to identify these early trends can help you spot key issues to fix as your business grows.

What is net profit?

Net profit uses your gross profit to calculate how much money you have left over after paying your other costs. Specifically, net profit takes into account your operating costs like rent, utilities, payroll, or website hosting, to give you a more conclusive figure of your profits.

Like gross profit, net profit can be a percentage. In these contexts, net profit tells you how much remains for you to use for your business for every £1 a customer spends. Net profit can also be a value in pounds and pence. In the next section, we’ll show you how to calculate both.

Typically lenders and investors prefer using net profit figures when considering your business’ health. Still, understanding each is important in showcasing your business’ performance.

How is net profit calculated?

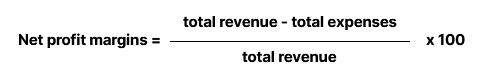

You can calculate your business’ net profit by combining all of your expenses (including cost of goods, supplies, taxes, and debt) and subtracting this figure from your total revenue:

Net profit = total revenue – total expenses

If you need this figure as a percentage instead (to find out your net profit margin), take the figure you’ve just calculated and divide it again by your revenue, then multiply by 100.

If you’ve found that your net profit is a negative number, this is because your expenses are larger than your revenue. Spending more than you make can be common for businesses at earlier stages as they set up and find a customer base. Many companies don’t actually see profitability until their second year. We’ll discuss what you can do to fix this in the sections below.

While net profits are typically expressed as percentages, you might find working with the number value easier while you’re in earlier stages in building your business. That way, you can directly plan how you’ll budget the number value with other cost values you know.

When transitioning to more long-term trading, using the percentage figure will become more useful as you scale your business and adapt your model.

How to use your gross and net profit figures

Changes to your gross profit month-to-month can help you detect early successes in the strategy you’ve taken to develop your business. Because this figure is directly tied to your product, you’ll be able to understand how the market and your customers are engaging with what you’re selling.

In contrast, net profit shows how successful your business is in how it runs. After deducting all your costs, your net profit lets you know how much you can reinvest in business areas going forward.

Depending on costs and revenue, finding your profits are negative at the net or gross level helps you understand where your business has to improve. With this insight, you can target specific expenses to reduce, and new areas to invest.

How Countingup can help you understand your profit figures

Countingup makes managing your business easier. By combining your business current account and accounting software in one app, we’ve automated the time-consuming aspects of your financial admin.

With all your important figures ready at a glance, you can quickly and easily understand how your profit figures change as you trade. Instead, you can focus on doing what you love and do best. Find out more about our competitive pricing for business owners here.

Receive actionable business tips weekly

By submitting this form, you confirm that you are 16 years of age or over and that you have read and agree to our Privacy Policy. You can unsubscribe at any time.