How you changed accounting in 2019

Table of Contents

In 2019 the way small businesses did their accounts completely changed

But that’s not all – the way you prepared for your taxes changed too. What is this new approach and why are businesses switching?

15 years ago I started my first business as a sole trader so I know small businesses hate being stuck in the middle of admin mess. That’s why it’s our relentless mission at Countingup to make it simple for you to run your business.

Our new idea and new approach is the business account that does your taxes and, thanks to you, 2019 was a transformational year for Countingup.

Momentum you created

- 800 You love Countingup! You’ve provided more than 800 independent reviews on Trustpilot, rating Countingup 4.6/ 5. You can add a review here (please do).

- 20,000 More than 20k businesses have now opened an account with Countingup. This has more than doubled over the last year.

- 250,000 Almost 250k payments are now made every month.

- 2,000,000 The number of transactions automatically categorised now exceeds 2m.

- 500,000,000 This year you transacted more than half a billion pounds, up from less than £100m the year before.

Award-winning, thanks to you

Voted for by customers like you, we won Best Business Banking App at the Accounting Excellence Awards quickly followed by the Innovation Award at the Contracting Awards.

It’s great recognition for a brilliant team. We thank you for your support!

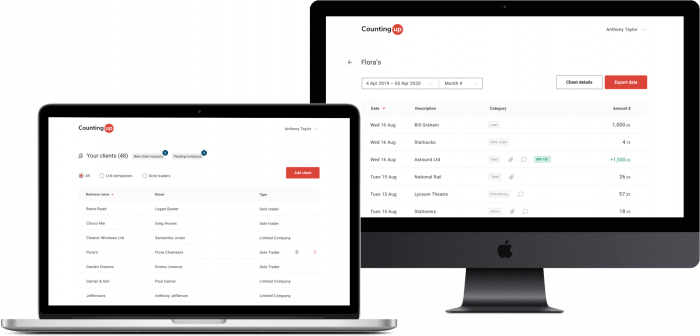

Collaborate with your accountant

We launched our Accountant Hub to give your accountant web-based, real-time access to your accounting data. No longer do they need to chase you for bank statements and receipts. More than 1,000 accountants are now partnered with Countingup.

To invite your accountant please follow the simple steps in this support guide.

It’s also a good idea to drop your accountant a quick email to tell them you are using Countingup and copy in accountants@countingup.com. We’ll be able to pick up the conversation to get them set up quickly.

Creating your one killer app

This year we added some massive features to Countingup to simplify running your business including invoices, credit notes and bills.

What to look forward to next

We’re fast approaching the 31 January tax deadline day for self-assessment.

The big feature we’re planning to ship in the first quarter of next year is our tax estimate tool. This will give you real-time visibility of how much your tax bill is likely to be. Keep the taxman at bay with peace of mind throughout the year!

Thank you to the visionaries

Back in 2017, when I first had the idea for Countingup, the majority of people I spoke to didn’t get it. Common pushback sounded something like: “Why wouldn’t you just use Barclays and Sage?”.

I’m glad I didn’t listen.

I’m grateful to our team, investors and to you, our customers, for helping us make banking and accounting in one possible. 2019 really has been a transformational year. Thank you all and here’s to another one in 2020.

If you have any feedback or comments for me please drop me an email at ceo@countingup.com.

Tim Fouracre

Founder & CEO

Countingup

Receive actionable business tips weekly

By submitting this form, you confirm that you are 16 years of age or over and that you have read and agree to our Privacy Policy. You can unsubscribe at any time.