How to register as a sole trader

Table of Contents

Running a small business and considering whether to register as a sole trader? In this article, you’ll find everything you need to know about setting up as a sole trader, including the pros and cons, costs and more.

What is a sole trader?

Sole traders typically consider themselves self-employed. In contrast to limited company owners, there is no legal distinction between the owner and the business by UK law. This means that as a sole trader, you are personally responsible for:

- Any business bills or losses (i.e. you could lose personal assets if things go downhill)

- Keeping accurate records of your business finances

If you’ve recently started a business and your income was over £1,000 in the last tax year, it’s time to set up as a sole trader or limited company.

How to register as a sole trader

All you need to do is register for a Self Assessment tax return through HMRC. You can do this by filling in a simple form online here.

Pros of registering as a sole trader

Becoming a sole trader has many benefits over creating a limited company. Here are some reasons:

Cost savings: Unlike creating a limited company, setting up as a sole trader is free.

Less admin: As a sole trader, you will have relatively less financial admin than a limited company director. You’ll just need to submit an annual tax return to HMRC. Meanwhile, limited company directors need to confirm that the information Companies House has about the company is correct each year. This is called a confirmation statement (previously an annual return).

More privacy: Your business details won’t be searchable via Companies House – unlike incorporated companies.

Cons of registering as a sole trader

If you are thinking of expanding your business, the simple business structure of a sole trader could present a barrier, as banks and investors typically prefer to lend / invest in limited companies.

Depending on your business’ profits, limited companies can be more tax efficient than sole traders – rather than Income Tax, they pay Corporate Tax.

Sole trader responsibilities

Even though it’s easier to set up as a sole trader, there are legal requirements you must adhere to, including:

1. Keeping accurate records for yearly Self Assessment

To easily complete and submit your tax return by the January 31st deadline, keeping an accurate record of your business’ sales and expenses will be key.

Fortunately, there are financial tools that make it easy for you to do this. Countingup is one of them. It’s the business account that saves you time by automating bookkeeping admin and helping you make smarter decisions with live cash flow insights. The app is unique for its inbuilt accounting software, saving thousands of sole traders money on accounting fees and time in automating admin.

2. Paying income tax

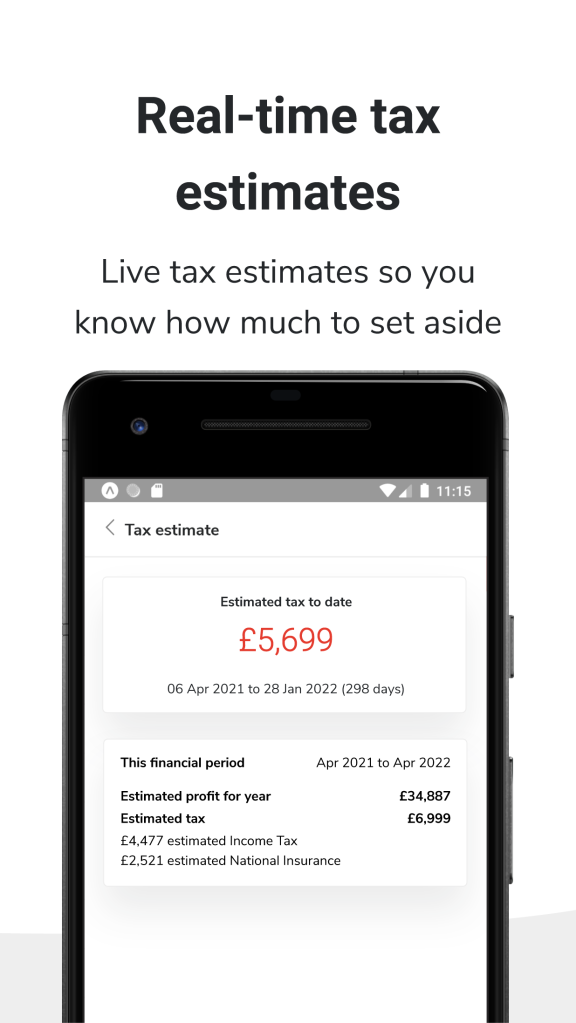

As part of your tax return, sole traders need to pay Income Tax on profits. Countingup’s live tax estimate tool will help you understand how much you’ll need to set aside for this – so that there are no last minute surprises.

Sole traders also need to pay Class 2 or Class 4 National Insurance fees. If you don’t have a National Insurance number, you can apply for one here.

3. Submitting a VAT return as a sole trader

If your turnover exceeds £85,000 you must register for VAT with HM Revenue and Customs (HMRC). Once you have successfully completed your application, you will receive a VAT registration certificate confirming your VAT number, and deadlines to submit your first VAT return and payment.

Setting up as a sole trader in the construction industry?

If you contract or subcontract in the construction industry, register with HMRC for the Construction Industry Scheme (CIS). In this scheme, contractors deduct money from a subcontractor’s monthly payments and pass it to HM Revenue and Customs (HMRC).

The deductions count as advance payments towards the subcontractor’s tax and National Insurance. If you are a subcontractor you don’t need to register, although it means that you will receive greater deductions from your monthly payments.

How to name your business as a sole trader

As a sole trader, you can either trade under your own name, or choose a name for your business. You won’t need to register this title. However, you must include it in official paperwork, including invoices and letters.

How not name your business

Before changing all your letter and invoice templates, make sure that your sole trader name does not:

- include ‘limited’, ‘Ltd’, ‘limited liability partnership’, ‘LLP’, ‘public limited company’ or ‘plc’

- Include any offensive words

- Infringe on an existing trade mark

There is also a list of sensitive words that you’ll need permission to use in your business name. For example, to include the word ‘Accredited’, you need permission from the Department for Business, Energy and Industrial Strategy (BEIS).

How to prevent someone trading under your business name

Once you have incorporated a company, no other UK company can legally use your chosen business name. In contrast, as a sole trader, you will need to register your name as a trademark to prevent other businesses from using it. The application fee is £170 and it could take up to 40 working days to be processed.

Receive actionable business tips weekly

By submitting this form, you confirm that you are 16 years of age or over and that you have read and agree to our Privacy Policy. You can unsubscribe at any time.