How to register a small charity with HMRC

Table of Contents

As a charity owner, it’s crucial to understand where and how to register your organisation with the proper authorities. One of these is Her Majesty’s Revenue and Customs (HMRC).

If you apply to the HMRC, it can mean that you can receive tax back when you get Gift Aid donations. The UK Government Gift Aid scheme allows your charity to claim an extra 25p for every £1 that donors give you.

This guide discusses registering a small charity with HMRC, which includes:

- What you need

- Where to go

- How to start

How to register a small charity with HMRC

What you need

Before registering a small charity with HMRC, they have a few requirements. To help you prepare for your application, we outline all the steps to set you up for it.

Register with the Charity Commission

If your charity’s income is more than £5,000 a year, you need to register to the

UK Government Charity Commission portal before applying to HMRC.

It will require you to provide information about your charity’s financials to prove that income.

That can include a bank statement that displays your incomings and outgoings. To make that easier, make sure you use a business account for finances.

Countingup is a business account with built-in accounting software which can help you access that information through your phone.

Its cash flow insights can also make sure you’re aware of the money that comes in and goes out of the organisation.

Bank account and financial details

Another crucial step before registering to the HMRC is that you have a bank account to provide details of. Aside from the accessibility benefit of a business account, it can also make your day-to-day management easier.

With a Countingup business account, keep your charity spending and income separate from personal finance. It’s essential to create a good work-life balance and helps you avoid mismanaging your organisation.

The Countingup app is more than a simple bank account. Its app allows you to sort your costs automatically with its expense categorisation feature.

It even uses HMRC approved labels, so it will keep you compliant before and after you apply.

Similar to the Charity Commission registration, the HMRC will also ask for evidence of your financial accounts. They will check whether you’re operating the organisation professionally.

Charitable objectives

HMRC will ask for details of your charitable objectives (sometimes called purposes). A charity can only be recognised if it has social goals that benefit the public.

The UK Government defines charitable purposes in the Charities Act 2011 as actions to help critical areas, these include:

- Poverty

- Environmental

- Health

- Human rights

- Arts

- Religion

- Education

- Community development

- Animal welfare

- Amateur sports

- Emergency services (police, fire brigade, ambulance or military)

If you can explain how your organisation addresses one of these areas, you’re able to apply to the HMRC. Each topic is broad so there are many different avenues to help people, your aims may cover more than one.

For example, a charity that provides safety for refugees and helps to house them. That organisation could cover human rights, poverty and community development.

The UK Government outlines how to write your charity objectives:

- What — specific aims

- How — strategy to reach them

- Who — people who benefit

- Where — location of work

Governing document

While registering a small charity with the HMRC, you must also provide a governing document. It will outline how the organisation runs and the rules to follow to keep it following its primary objectives to help people.

There are some critical details that the UK Government suggest you include in your governing document, these include:

- Purposes — outlined in your charitable objectives

- Management — who you are and how you run the charity

- Trustee appointment — how you were appointed and if you intend to bring on others in future

- Trustee expenses — your allowance as a trustee for business costs (e.g. petrol)

- Trustee payments — what income you’ll receive from the organisation

- Closure plan — how you’ll close the company if you need to (e.g. meet the aims)

In addition to that information, it’s also crucial that you sign the document to ensure you understand its terms.

Where to go

Now that you have everything you need, you’ll need to know where to go when registering a small charity with HMRC.

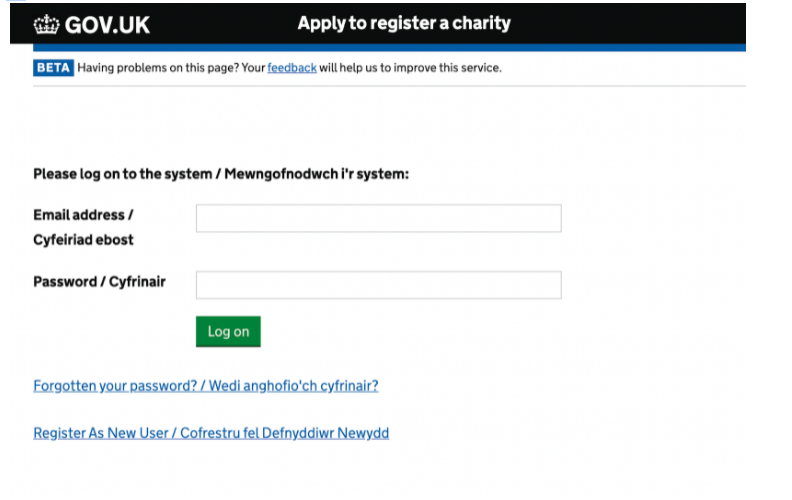

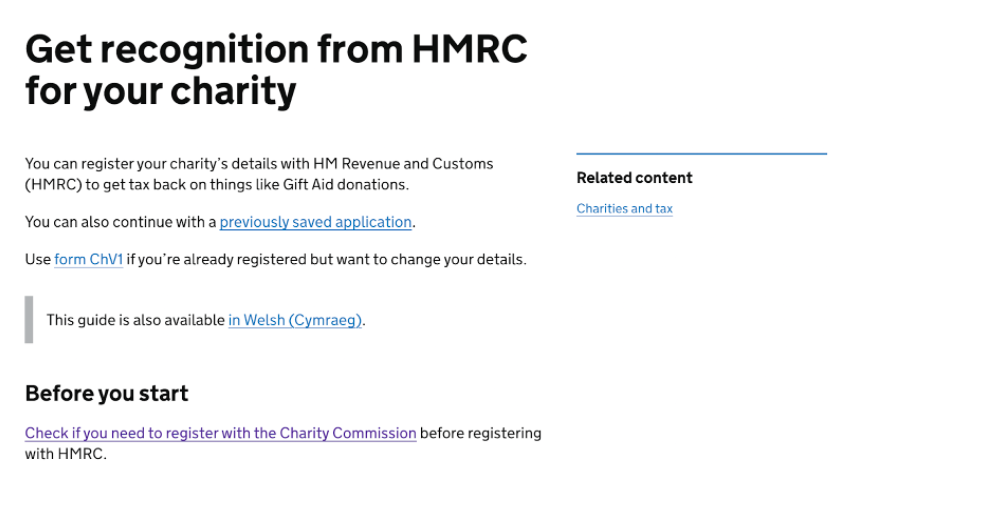

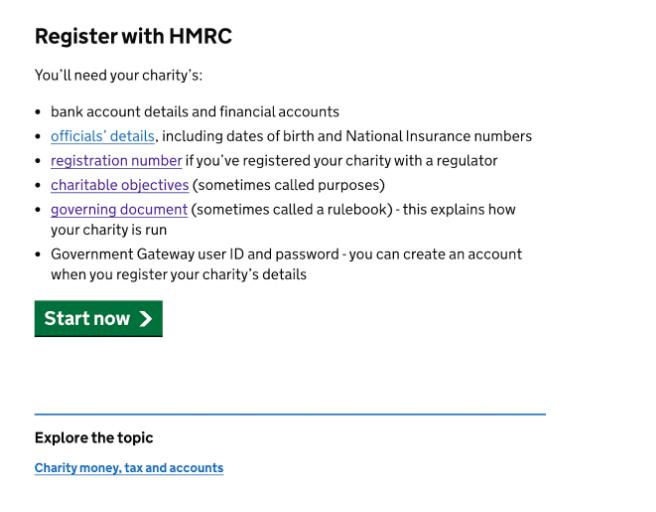

The UK Government has a portal. If you open that link in another tab, you should find a page like this.

It displays the relevant information you need to get HMRC to recognise your charity.

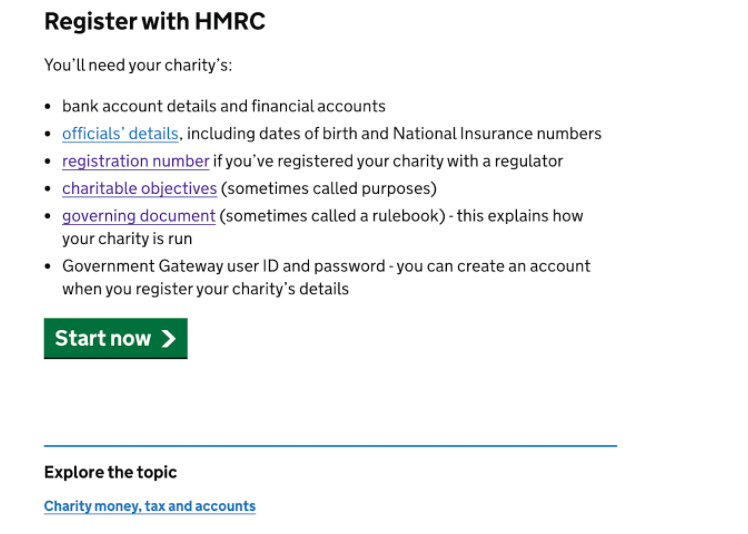

Further down the page, you’ll notice that you have everything prepared from earlier in this article. The final step before you begin is to create a Government Gateway account for your charity.

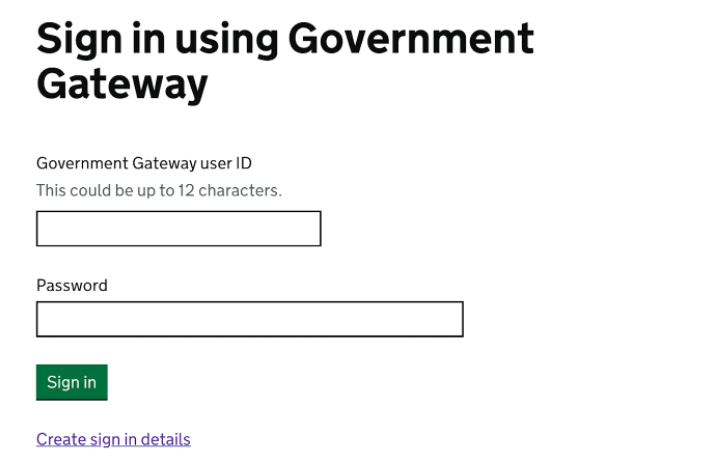

Use this UK Government portal to create an account. They will ask you for contact details and a password which you’ll use to sign in on behalf of your organisation.

How to start

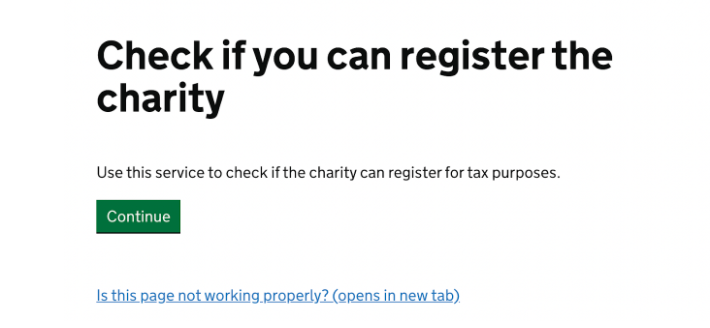

Now that you know what you need and where to go, it’s time to register a small charity with HMRC. Direct yourself again to the UK Government portal.

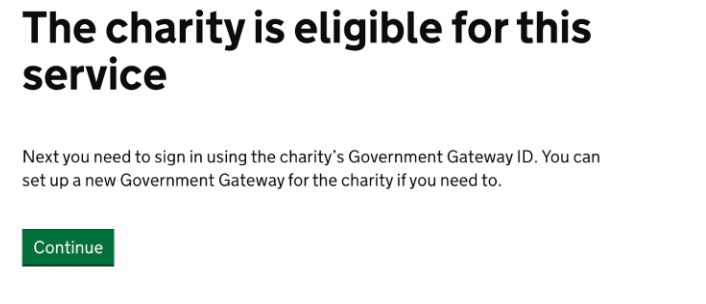

When you click ‘start now’, it will take you to a service that checks the eligibility of your charity.

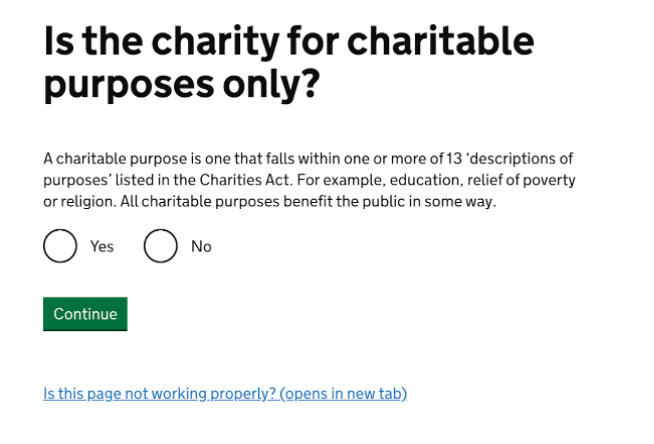

The system will ask if your charity follows one of the purposes set out in the Charities Act, which you describe in your charitable objectives.

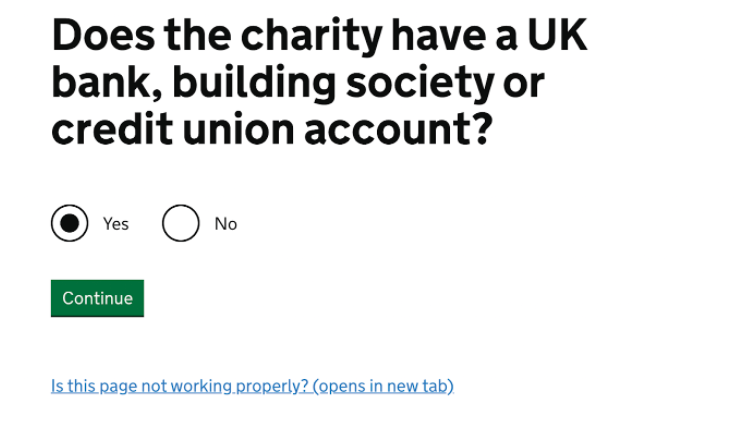

Additionally, the service will ask if you have a UK bank account. You can use Countingup and take advantage of its features on the go through your phone.

If your charity is in the UK, you will get an approval of your eligibility to apply. Click continue, sign in with your Government Gateway ID and follow the on-screen instructions.

Countingup can help with more than just your setup

Now you’re able to register your charity with the HMRC with those instructions, take a moment to learn how Countingup can make the rest of your management more straightforward.

The business account with built-in accounting software has many features to help run your organisation. For fundraising events, for example, if you buy essentials from stores, you can seamlessly add paper bills to your accounts.

Countingup’s receipt capture feature allows you to use your phone’s camera to upload those costs straight into your accounts.

For more tips for you charity, see:

Receive actionable business tips weekly

By submitting this form, you confirm that you are 16 years of age or over and that you have read and agree to our Privacy Policy. You can unsubscribe at any time.