How to budget money for your growing business

Table of Contents

One of the biggest risks to your growing business is running out of money. With 20% of small businesses failing in year one and 50% in the first five years, having a budget in place is essential for beating the odds.

Creating a budget starts with keeping track of the money you have, how much you will need to spend to run your business, and importantly, how much you need to earn to meet your goals.

Keep reading to find out how to:

- Understand how much money you have

- Understanding your fixed and variable costs

- Plan for unforeseen circumstances

- Create a profit & loss statement

- Set aside money for the future

1) Look at the money you have

Start by looking at how much your business currently earns. Take a note of all your income sources, and determine how much you generate every month.

How much you earn each month is called your revenue and includes all the money coming into your business before costs. We will talk more about profit later, which is the total after you deduct your expenses from your revenue.

Once you know your monthly earnings, it’s time to work out your revenue history over the past six to 12 months. However, if you have started a new business and don’t have these numbers, you can use industry averages as a rough guide of how much to expect.

Charting out your revenue history allows you to understand how your income fluctuates and identify any patterns to start creating cash flow forecasts and forward planning. For instance, you can spot months that may be financially tougher for your business and plan accordingly.

2) Work out your fixed costs

Next, you want to work out your fixed costs. Fixed costs are simply any recurring expenses or, in other words, expenses that remain the same and aren’t impacted by your business’ sales or production.

You may also hear fixed costs referred to as ‘overhead costs’ and can include fees such as ongoing website costs, rent, insurance, debt repayment, etc.

3) Work out your variable costs

As part of determining your budget, it’s helpful to work out your variable costs. Variable costs are the expenses that change in relation to how much your business produces or sells.

Variable costs can include the raw materials you use to make your products, labour associated with making your product, as well as packaging and shipping. The more your firm grows and produces, the greater these variable costs will be.

For example, if you run a cake business, your variable costs would include fees for ingredients like flour, milk, sugar, etc. Your variable costs would also include the cost of packaging and shipping to customers. The more cakes you produce, the more money you need to have on hand.

4) Set aside funds for one-off or unforeseen costs

Having emergency funds to draw from gives you a safety net and prevents your entire budget from being knocked off course. You want to set funds aside whenever possible.

In the example of our cake business, it would be useful to set aside extra funds to pay for an unexpected breakdown in your mixing equipment or a faulty oven.

5) Make your profit and loss statement

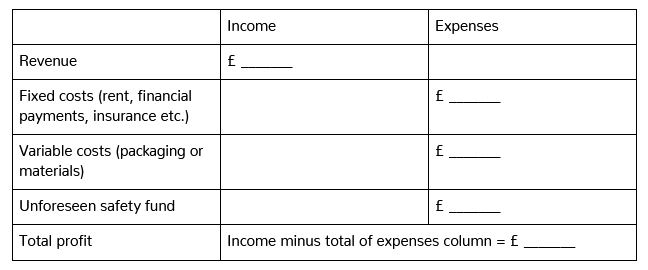

Once you have worked out your monthly earnings and outgoings, you need to put this information into a profit and loss statement. You can create a profit and loss statement by adding up your income for the month and calculating all your expenses (fixed, variable, and unforeseen). Then, take away your total expenses from your monthly income to get your company’s ‘cash flow’.

If you have a positive number at the end, congratulations, you are making a monthly profit! However, if you get a negative number, then this means you’re running in the red and aren’t a profitable business yet.

It’s a good idea to keep a close eye on your profit and loss on a monthly as well as quarterly basis.

6) Look to the future and draw up a forward-looking business budget

Your profit and loss document acts as a record of how much your business has previously made. You can use those figures to make an estimated budget. This will outline your plans for how much you expect to spend and make going forward.

You can use the profit and loss document to identify any patterns or trends to explain the ups and downs in your finances, understand where and when you should invest your money, and recognise any financial mistakes you have made and can avoid in future.

You might also recognise patterns such as seasonal trends – a cake company might sell more cakes around Valentine’s Day and Christmas. By looking for reasons to explain patterns or ups and downs, you can predict what your next financial year will look like and understand where to focus resources. For instance, you might want to budget for more resources during busy periods so you can maximise your profitability.

How to budget money efficiently

Now that we’ve outlined why it’s important to budget money for your business and explained how you might work this out. You could use a simple spreadsheet on Google Sheets to help you keep track of your finances everyday, or a simple financial app, like Countingup, to make this process as efficient as possible.

While it’s not the most glamorous part of growing your business, keeping track of your budget will help you to meet your goals and make your life as a business owner much easier.

How Countingup can help

With Countingup, you can apply for a business current account online in minutes and for free. It automates the time-consuming aspects of financial admin, saving thousands of UK business owners time and money. Find out more here.

Receive actionable business tips weekly

By submitting this form, you confirm that you are 16 years of age or over and that you have read and agree to our Privacy Policy. You can unsubscribe at any time.