What is a cash flow statement?

Table of Contents

Every business needs to understand three key financial documents: the income statement, balance sheet and cash flow statement. This guide will focus on the cash flow statement.

We’ll go over:

- What is a cash flow statement?

- Why are cash flow statements important?

- What do cash flow statements show?

- Which methods can I use to create a cash flow statement?

- What is negative and positive cash flow?

- How do I create a cash flow statement?

What is a cash flow statement?

A cash flow statement tells you how much money enters and leaves your business: your cash flow. Your cash flow statement is vital for managing your accounting and making sure you have enough cash to keep working, along with balance sheets and income statements.

Cash flow statements measure how well a company generates cash to pay its debts and fund its operating expenses, such as bills and supplies. The cash flow statement has been a mandatory part of a company’s financial reports since 1987.

Why are cash flow statements important?

A cash flow statement is important because companies need to be aware of how they are doing financially. Without a solid grip on your cash flow (money entering and leaving your business), you might miss trends that could significantly impact your business’ financial health.

For example, you may think business is doing great because you work on several projects with different clients or sell lots of products. However, if your clients are slow to pay their invoices, it could create a bottleneck stopping you from paying your financial obligations.

A cash flow statement gives you a correct picture of your cash flow so you can make sure you have enough money to pay your expenses.

What do cash flow statements show?

A cash flow statement covers three critical aspects of your business activities to show any changes. These are as follows:

Operating activities

Your regular business activities. Inflows include money you make from selling products or services, dividends (shareholder profits) your business receives, interest, and other cash receipts. Outflows include expenses, taxes, and payments to suppliers and vendors.

Investing activities

Your gains and losses from investments. Inflows include sales from business assets (valuable items you can sell for cash) and any payments from loans your business extends to others. Outflows include buying assets and loans your company makes.

Financial activities

Capital (business worth) that’s raised outside your company. Inflows refer to any money you’ve borrowed as a business and selling your company’s securities, such as property. Outflows include dividend payments (profits you distribute to shareholders) and paying off debt.

Which methods can I use to create a cash flow statement?

There are two ways to prepare a cash flow statement:

Direct method

In this method, you represent your operating cash flow (money directly linked to your operational activities) as a list of ingoing and outgoing cash. You essentially subtract the money you spend from the money you receive.

Indirect method

The indirect method is a little more complicated than the direct method. Here you show your operating cash flow as a link between profit and cash flow. This means you’ll also need to factor in any depreciation* into your calculations. The indirect method gives you information on cash generated from different activities, describing the effects that any changes in your asset and liability accounts have on your cash position.

*Depreciation refers to when an asset loses value.

What is negative and positive cash flow?

A negative cash flow means you lost money during that specific time period, showing your cash flow ratio (your inflows compared to your outflows) as a negative number (below 0). Negative cash flow doesn’t have to be bad for your business –– some months, you might invest in expensive equipment that will allow you to make more money later.

However, if you find yourself with an ongoing negative cash flow, you may need to find a way to bring in more cash. Or, you’ll need to cut some expenses to keep your business running.

Positive cash flow means you make more money than you spend, showing your cash flow ratio as a positive number (above 0). While positive cash flow is the goal for every business, it doesn’t always mean you’re doing as well as you think.

For example, taking out a large loan will make your cash flow show up as positive. However, this is a short-term fix and doesn’t mean your business is profitable. You also want to look at where the cash comes from when examining your cash flow statement.

Learn more about what is a healthy cash flow ratio.

How do I create a cash flow statement?

Cash flow statements may seem complicated, but they’re pretty simple if you have a good system in place. Follow these steps to prepare a cash flow statement:

Step 1: Gather important documents

You need the following documents to create a cash flow statement:

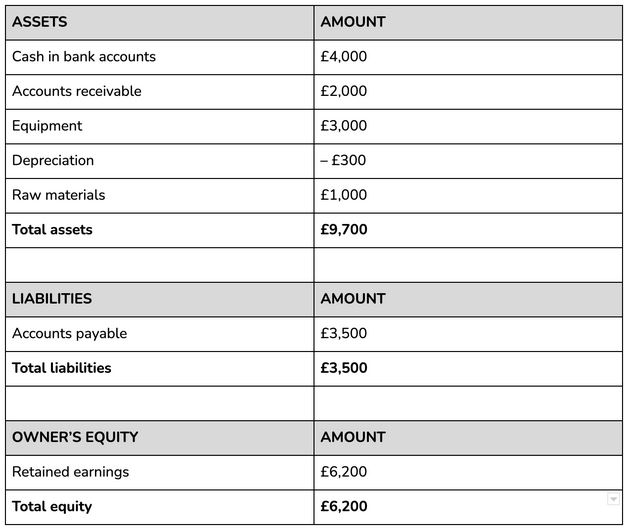

- Balance sheet (provides a snapshot of your business’ current financial position)

- Statement of comprehensive income (contains the details of the revenue, income, expenses, or loss before they’re achieved or cleared)

- Statement of changes in equity (records changes in your company’s worth during different time periods)

You also need any previous cash flow statements and information about any material transactions your company made. These might include: contracts, legal files, investment documents, and so on.

Step 2: Calculate changes in the balance sheet

Next, work out any changes to your balance sheet over the current time period. The easiest way is probably to look at all your assets, equities, and liabilities and subtract the closing balance (the sum on your last balance sheet) from the opening balance (the sum on your current balance sheet).

Step 3: Put all balance sheet changes on your cash flow statement

Add the changes into a blank cash flow statement. Be sure to add them to the appropriate section. It’s crucial to separate cash flow coming from operating activities, investing activities, and financial activities since they affect your business in different ways.

Step 4: Adjust for non-cash items

Now that you’ve started your cash flow statement, you need to identify any potential non-cash items you may have recorded on the balance sheet. Non-cash items include tax expenses, foreign exchange differences, and so on. Once you find these items, remove them from the statement.

Step 5: Do final calculations

Finally, sum up all the individual listings and calculate the overall change in the balance sheet while adjusting for non-cash items. These final calculations will give you the total cash flow for that statement.

Below we’ve created an example of what a cash flow statement might look like for a small business:

Stay informed about your cash flow with Countingup

The Countingup business current account is helping thousands of UK business owners manage their finances easily. The app comes with free built-in accounting software that automates the time-consuming aspects of financial admin. You’ll receive real-time insights into your cash flow with profit and loss reports, tax estimates and more.

You can also share your bookkeeping with your accountant instantly without worrying about duplication errors, data lags or inaccuracies. Seamless, simple, and straightforward!

Download the Countingup app to apply for your business current account in minutes. All you need is proof of ID and a selfie. Find out more here.

Receive actionable business tips weekly

By submitting this form, you confirm that you are 16 years of age or over and that you have read and agree to our Privacy Policy. You can unsubscribe at any time.