The 50/30/20 budget rule: everything you need to know

Table of Contents

When it comes to managing your finances, there are many approaches to choose from. While some recommend spreadsheets, a special app or a financial adviser, many cite the 50/30/20 budget as one of the most straightforward ways to manage your money. In this article, you’ll learn what 50/30/20 involves, how it works and its pros and cons.

What is the 50/30/20 budget?

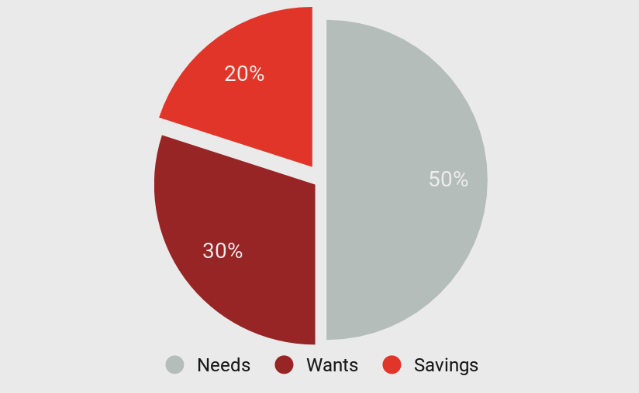

In essence, it is a plan that advises you to divide your monthly net income into three categories, based on the ratio 50:30:20. Following the plan, you would:

- Spend up to 50% on your essential needs and financial obligations

- Spend up to 30% on non-essentials

- Set aside 20% for savings

Let’s take a deeper dive into each category:

- The essentials

This involves setting aside 50% of your post-tax income on things that you need, including utility bills, insurance, rent or mortgage payment, commute costs, health care and groceries.

So, if your monthly after-tax income was £2000, following the 50/30/20 budget, you would allocate £1000 to spend on your needs. If, however, your essential expenses exceeded 50% of your income, you could make some changes to reach a healthier financial situation, for example, by switching to a cheaper insurance or energy provider.

2. Non-essentials

The 50/30/20 budget advises spending 30% of your post-tax income on things that you want, things like:

- Film and music streaming subscriptions

- Eating out / getting takeaways

- Clothing

- Alcohol and fancy food

- The latest tech gadgets and upgrades

- Holidays

If you find that your non-essentials exceed 30% of your net-income, you could consider eating out less regularly, spending less on alcohol or more expensive food items, or searching for better deals on holidays.

3. Save

Those following the 50/30/20 budget put 20% of their net income towards savings each month. Some of that money could be allocated to an emergency fund in a savings account. As we mention in our guide to improving cash flow management, setting aside several months of emergency savings is one of the most important financial strategies you could implement. Once you’ve created an emergency fund, you could invest in the stock market or government bonds.

Who created the 50/30/20 budget rule?

Before running for president, US Senator Elizabeth Warren was a bankruptcy and personal finance lawyer, as well as a law professor at Harvard University. In her co-authored book, All Your Worth, she references over 20 years of research and explains how keeping on top of your finances is simple with the 50/30/20 budget plan. In the book, Warren acknowledges that the approach is not an overnight solution to personal finances, rather an effective technique when applied over a period of time.

Why should I follow it?

By spending less and saving more, getting into the habit of the 50/30/20 rule makes it easier to reach financial goals. The theory goes that by balancing your expenses across these categories, you’ll be more cost-conscious and thoughtful with your spending habits, and avoid overspending.

Cons of the 50/30/20 budget

While it has potential to improve your financial wellbeing, as with any one-size-fits-all budget, 50/30/20 is not for everyone. Here’s a quick summary why:

- It is income-dependent and encourages unnecessary spending

Depending on your income, you may need to spend more than 50% of your earnings on your essentials. Spending as much as 30% on things you don’t need can be impractical and prevent you from reaching your financial goals.

2. Setting aside 20% for savings may not be enough

20% per month into a savings account may not enable you to reach the financial goals you have in the time you want to achieve them, such as saving up for a car or putting a deposit on a new home by the end of the year. Limiting 20% of your net income to savings may be frustratingly slow – and not the ideal approach depending on your situation. Switching the last two categories of 50/30/20 – instead saving 30% and using 20% for discretionary spend, may be the smarter choice.

3. What to do with remainders?

The 50/30/20 budget doesn’t recommend what you should do if you’re spending less than 50% or 30% of your net income on your needs or wants, respectively. It’s up to you to choose what to do with the extra money – either by spending more on your wants, or placing more into your savings. There isn’t a wrong answer here, but some would prefer a plan that recommends where every extra penny should be placed, based on their financial situation.

So, what’s the right answer?

The 50/30/20 budget can be a good place to start. However, to create a budget plan that matches your lifestyle, you may find it useful to:

- Create a list of your essential expenses

Once you have broken down your monthly spending on essentials, you could look for ways to reduce the costs as an initial step. Next, subtract your monthly essential expenses from your monthly income and…

- Decide how you would like to divvy up the rest

Prioritising savings over discretionary spending will help you build up your wealth faster. First save up for your emergency fund. Next, any debt repayments. Then, deposits, for example, a home or car. If you have a deadline in mind for any savings goals, calculate how much you would need to save per month to make it happen.

- Create a separate pot for discretionary spending

Once you have an idea of how much you would like to save, you could spend the remainder of your monthly income on your wants. A separate bank account may be useful here so that you don’t confuse your discretionary spending pot with your needs or savings.

Shape up your finances

Creating and following a set budget is a great way to become more savvy, confident and in control when it comes to your personal finances. As with many things in life, getting this right is a work in progress and something to evaluate and adjust each month. Although the 50/30/20 budget has its benefits, a personalised budget plan based on your income, savings goals and discretionary spending is likely to be a better way of meeting your financial needs in the long term.

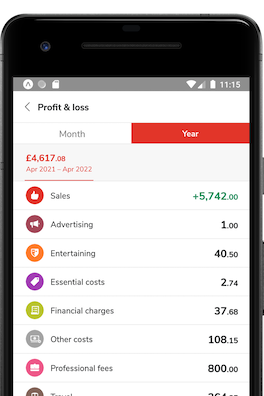

If you’re self employed, a freelancer, or a sole trader, there are many approaches to optimising your business finances. Countingup is one of them. It’s the business current account that automates accounting, saving time and money for over 30,000 sole traders, self-employed people and small business owners in the UK. It provides an up-to-date picture of your profit and loss, automatically categorises expenses and gives live tax estimates all year so that you know how much to set aside.

Find out how you can save time and money with the Countingup app

Receive actionable business tips weekly

By submitting this form, you confirm that you are 16 years of age or over and that you have read and agree to our Privacy Policy. You can unsubscribe at any time.