How to write a balance sheet for a business plan

Table of Contents

A balance sheet is one of three major financial statements that should be in a business plan – the other two being an income statement and cash flow statement.

Writing a balance sheet is an essential skill for any business owner. And while business accounting can seem a little daunting at first, it’s actually fairly simple.

To help you write the perfect balance sheet for your business plan, this guide covers everything you need to know, including:

- What is a balance sheet?

- What are assets?

- What are liabilities?

- What is equity?

- How to write a balance sheet

What is a balance sheet?

A balance sheet is a financial statement that shows a business’ “book value”, or the value of a company after all of its debts are paid.

For those inside the business, it provides valuable financial insights, allowing the owners to assess their current financial situation and plan for the future.

For external investors, a balance sheet lets them know whether it’s a worthwhile investment.

Elements of a balance sheet

Putting a balance sheet together isn’t all that difficult. You just need to know the value of three things:

- Assets

- Liabilities

- Owner’s equity

Once you know these three figures, there’s just a little bit of maths – nothing too scary though.

Assets

Assets are items or resources that have financial value. They might be physical items, machinery and vehicles, or they could be intangible items, like copyrights or brand identity.

Assets are separated into two groups based on how quickly you can turn them into cash. There are current assets and fixed assets.

Current assets are things that are fairly simple to value and sell, such as:

- Stock and inventory

- Cash in the bank

- Money owed to you (through unpaid invoices)

- Customer deposits

- Office furniture, equipment or supplies

- Phones or laptops

- Even relatively trivial items like a coffee machine or pool table

Fixed assets are valuable items that take much longer to sell, such as:

- Property or buildings

- Machinery

- Specialised equipment for your business operations

- Investments

- Vehicles

On your balance sheet, the asset column is the simplest. All you need to do is list each item your business owns, along with their individual values, in a separate column. Then, add up the values to get a total at the bottom.

Liabilities

Liabilities are the funds that you owe to other people, banks, or businesses. They can be:

- A business loan (the total, not the monthly payment amount)

- A mortgage or rent payment on a property

- Supplier contracts you owe

- Your accounts payable total

- Other financial obligations, such as paying wages or freelancers for support

- Taxes you’ll owe to HMRC

List these in the same way you did with your assets – on a spreadsheet with their values in a separate column.

Equity

When you know the value of your assets and liabilities, working your equity is simple – it’s just the total value of your assets, minus the total value of your liabilities.

Record the owner’s equity in the same column as your liabilities. When you add them all up, it should be the same value as your assets.

How to write a balance sheet

After you’ve totalled up your assets, liabilities, and owner’s equity, all that’s left to do is fill in your balance sheet.

Using a spreadsheet, record your assets on the left and your liabilities and owner’s equity on the right.

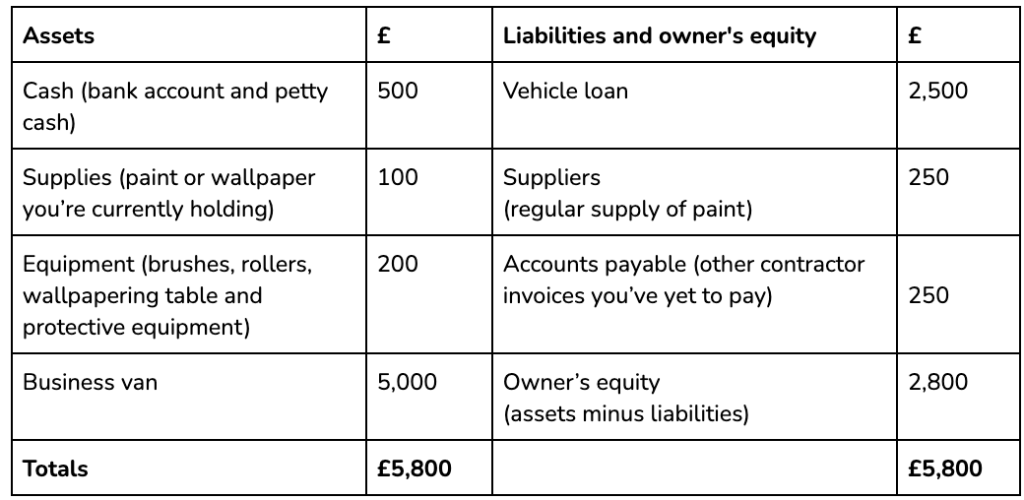

For example, here’s what a balance sheet might look like for a painter and decorator:

If you’ve recorded everything correctly, both sides should have the same total. Whenever you make a change, the balance sheet will change, but it should still be balanced.

For example, let’s say our painter and decorator sold their equipment. In that case, they’d lose an asset worth £200, but they’d also gain £200 in cash, so the asset total would stay the same.

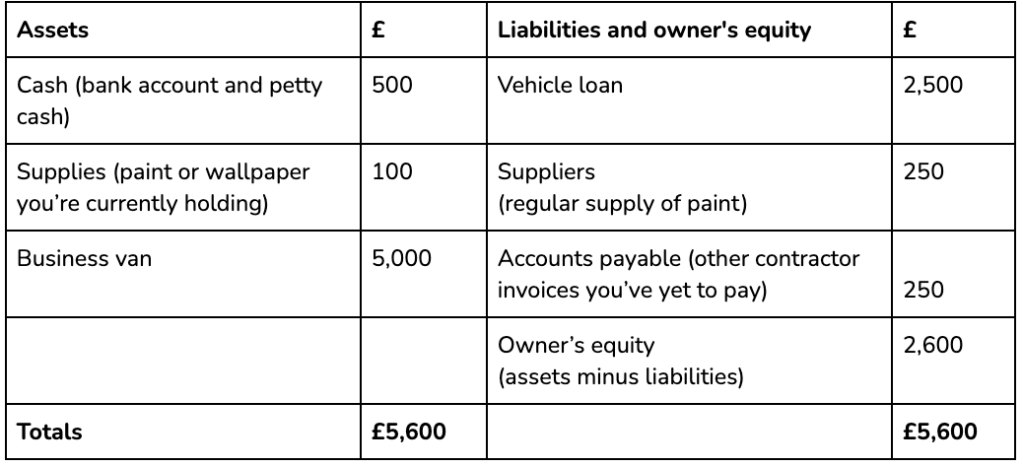

Alternatively, let’s say they lost the equipment altogether and got no money for it. In that case, they’d lose £200, leaving their asset total at £5,600. Then, they’d have to adjust the other side, so it remains balanced, like this:

If your two totals are not balanced, it’s most likely for one of these reasons:

- Incomplete or missing information

- Incorrect data entry

- A mistake in exchange rates

- And inventory miscount

Basically, if things don’t look right, try not to panic. It’s normally a simple mistake, so go over the figures again and you’ll find the culprit.

Manage your business finances with Countingup

The trickiest part of writing a balance sheet for a business plan is accurately recording financial information.

With the Countingup business current account, you’ll have access to a digital record of all your transactions in one simple app, giving you all the financial information you’ll need for a business plan.

Start your three-month free trial today.

Find out more here.

Receive actionable business tips weekly

By submitting this form, you confirm that you are 16 years of age or over and that you have read and agree to our Privacy Policy. You can unsubscribe at any time.