Do builders have to be VAT registered?

Table of Contents

Are you a builder looking to stay tax compliant? Find out whether builders and other construction workers have to be VAT registered, and more, in this article.

We’ll cover everything you need to know about thresholds and VAT registration for builders. Find out the answers to these questions:

- When do builders have to be VAT registered?

- What happens if you go over the VAT threshold?

- What is Making Tax Digital for VAT?

- What VAT rates are applied in the construction industry?

- What happens if you charge the wrong rate of VAT?

- What is ‘reverse charge’ VAT?

- How can builders manage VAT returns more effectively?

If you’d like more context about VAT and how to register, see our dedicated articles: What is VAT?, How to Register for VAT, and How to Pay VAT.

When do builders have to be VAT registered?

UK businesses, builders included, have to register for VAT if their taxable turnover is over £85,000. Once registered, businesses must follow ‘Making Tax Digital’ rules for their first return starting on or after April 2022 (we’ll cover more of this in a later section).

The £85,000 threshold is calculated as the total value of everything you sell (goods and services) as a business that has VAT applied to it. Therefore, this means you’ll need to be aware of which goods and services need to have VAT applied and the correct rates. Find out more about exemption in our article What Items are Exempt from VAT? and see a list of different VAT rates on the UK Government website.

The £85,000 threshold changes each new tax year and there are different rates applied to businesses operating in Northern Ireland if any goods or services come from the European Union.

What happens if you go over the VAT threshold and aren’t registered yet?

There are some circumstances where it may not have been clear if your turnover would pass the threshold. In these situations, HMRC still requires you to register for VAT within 30 days.

If you exceed the threshold in the next 30 days

You must register for VAT by the end of the same 30-day period. When calculating your new VAT figure for future trading, HMRC states you must use your registration date – not the date your turnover went over the threshold.

If you exceeded the threshold in the past 12 months

You must register within 30 days of the end of the month in which you went over the threshold. When calculating your new VAT figure for future trading, HMRC specifies to use the first day of the second month after you go over the threshold.

If your business is near the threshold, you can sign up for VAT early and be covered ahead of time when your turnover grows.

What is Making Tax Digital for VAT?

Making Tax Digital (MTD) is a way of handling your business’ accounting and VAT returns using integrated software like Countingup. Currently, MTD is live and small businesses need to register for Making Tax Digital for VAT by April 2022. Find out more about MTD and what it means for your small business in our articles What is Making Tax Digital? And How do you sign up for MTD?

What VAT rates are applied in the construction industry?

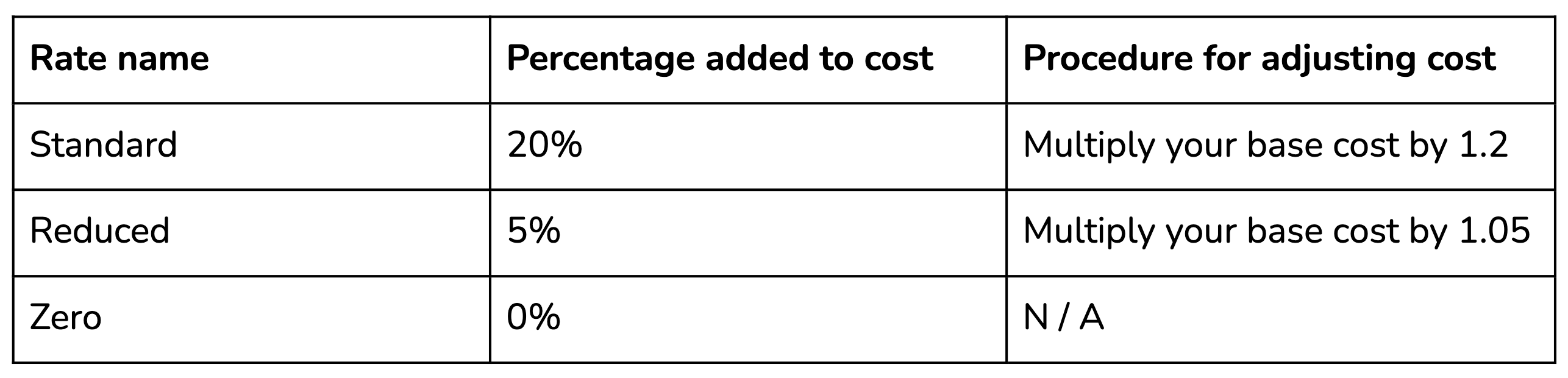

VAT is charged at three rates:

The standard rate has been set at 20% since 2011 and covers most goods and services. The reduced and zero rates cover things that have some beneficial environmental impact or help provide financial relief for vulnerable groups. Examples include renovation work in the homes of people in wheelchairs or restoring an important cultural building. Therefore, as a builder, you may have to adjust your prices depending on the client or project.

Sales of goods and services charged at the zero rate still have to be recorded and disclosed as part of your VAT Returns four times a year.

What happens if you charge the wrong rate of VAT?

When submitting VAT returns to HMRC, it’s essential you have the right rates applied. Otherwise, you cannot claim all of the amount you’ve paid back.

Reclaiming VAT requires you to track the VAT you’ve paid versus the VAT you’ve charged, with a refund granted if you’ve paid more than you owe. However, if you owe more, or haven’t proven you’re due a certain amount back, HMRC may not grant your VAT refund.

What is ‘reverse charge’ VAT?

The UK government has recently extended part of the Construction Industry Scheme (CIS) since 1st March 2021. VAT reverse charge applies to supplies of building and construction services wherein companies that supply construction services to VAT-registered customers don’t account for VAT.

The domestic VAT reverse charge must be used for most supplies of building and construction services (including standard and reduced rate goods or services). As an end-consumer of building materials, your business’ VAT returns may be affected. Find out more about the reverse charge scheme and what you need to do here.

Manage VAT returns more effectively

Tracking VAT rates across all your business’ accounts can be time-consuming. Instead, use Countingup to save on the time and stress of your financial admin and be ready for the MTD era.

Countingup is the business current account and accounting software in one app and provides a digital tax filing service. With it, you can automate VAT calculations associated with each of your business transactions and make paying your VAT bill easier. Countingup also makes sharing your business’ finances and VAT records with your accountant as easy as the touch of a button.

The Countingup app also offers real-time profit and loss statements, automated invoicing tools and expense reminders, complete with a receipt capture system.

Gain more insight into your business’ performance and stay tax compliant while trading.

Find out more about Countingup here and sign up for free today.

Receive actionable business tips weekly

By submitting this form, you confirm that you are 16 years of age or over and that you have read and agree to our Privacy Policy. You can unsubscribe at any time.